Good Food Institute (GFI) released a new analysis showing that, despite challenging macroeconomic and market conditions, investment interest in the alternative protein sector remains, with 99% of investors surveyed expressing optimism for its long-term prospects.

“Continued growth of the plant-based category will be enabled by innovation resulting in tasty and attractive options”

Observing the rapid growth of alt-protein investment over the past decade, which doubled YOY and now stands at nearly $14.2 billion globally, GFI notes a significant slowdown and slowdown in investment last year, from $5.1Bn in 2021 to $2.9Bn in 2022.

This trend aligns with a 35% decline in overall global venture funding that occurred over the same period. Despite this slowdown, GFI points out that the world’s largest protein producers are increasingly involved in the alt-protein industry: half of the 60 largest global meat, dairy and seafood companies tracked in the Kola FAIRR Protein Producer Index are investing in the alternative protein market as of 2022, amounting to 2019 More than double.

Other key findings in GFI’s analysis:

- Between 2019 and 2020 capital almost tripled while investments returned to pre-pandemic levels. Investment continues to grow in 2021 with record-breaking initiative funding across most sectors.

- Even with this recalibration, 2022 investment still exceeds the $1.1 billion raised in 2019, largely considered the ‘breakout’ year of alternative proteins.

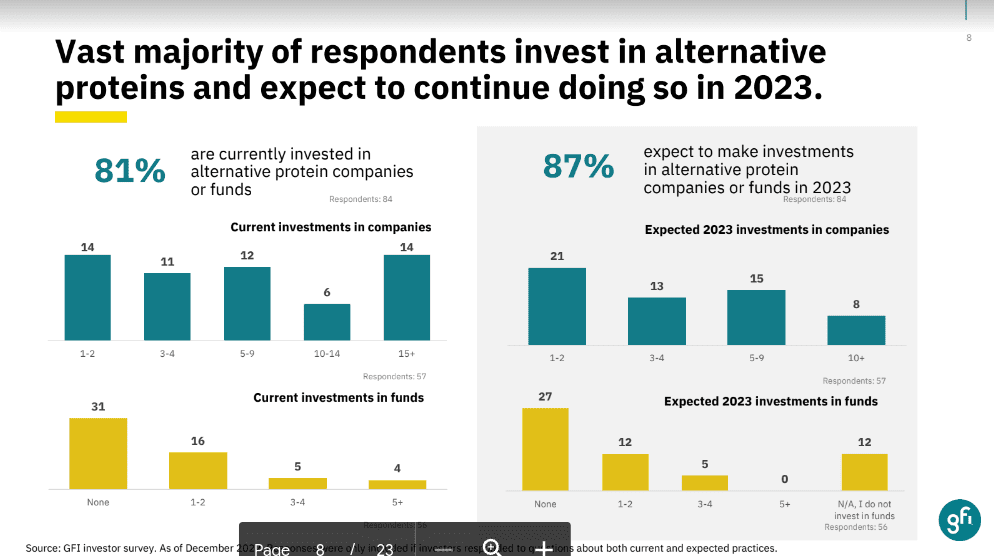

- Declining investment amid an uncertain market environment could impact the alternative protein industry in the coming years: a GFI-led Survey of investors Currently active or entering Alternative Protein shows that those who slowed down their Alternative Protein investments in 2022 did so primarily due to broader market and economic conditions.

99% shows optimism

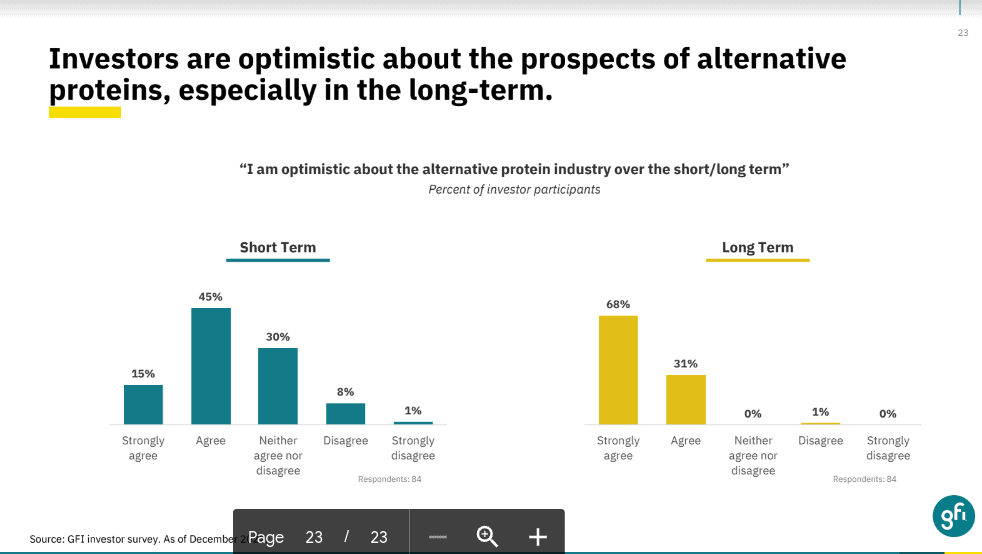

Anyway, same Survey It found that optimism for the potential of alt-proteins remains high, particularly for emerging areas such as fermentation, cultured dairy and alternative fats.

- 99% of survey respondents agree or strongly agree with the statement “I am optimistic about the alternative protein industry in the long term.”

- 45% of respondents noted that their investment in alternative proteins has not slowed in 2022, however 87% are expected to invest in alt-protein companies or funds in 2023.

- Most respondents expect increased investment in more innovative alternative protein categories, particularly fermentation, cultured dairy and alternative fats.

- Respondents expect increased investment in B2B/materials and equipment business models, which is a critical requirement for the sector to scale.

According to GFI, the alt-protein industry is still in its early days and will continue to navigate a complex and challenging environment, but the future outlook looks very promising.

Creating a winner

“Continued growth in the plant-based category will be enabled by innovation that results in tasty and attractive options. As consumers increasingly seek alternative proteins for personal health and environmental reasons, winners will be created in the category and generate strong returns for investors,” said the private equity firm. El Caterton Vice President Alice Raksin.

Sharyn MurrayGFI Investor Engagement Manager, said, “As companies continue to develop new technologies, as well as scale and optimize production to improve product taste and affordability, sales will accelerate and encourage additional investment – especially as macroeconomic and market conditions normalize.”

Click here for GFI Investor Survey And Detailed analysis.